How To Study For B.Com With Google Gemini AI

Strengthen Your B.com Performance With Google Gemini AI.

Studying for a B.Com degree sets you up for a high-value career in finance, accounting, and business analysis. To succeed, you need to master tough subjects like Accounting, Business Law, and Statistics and hit the required college cutoffs. It can feel overwhelming, but since you are here looking for advanced help, success is guaranteed with the right strategy. You actually have an always-on tutor: Artificial Intelligence (AI) is your secret weapon. AI can instantly explain complex problems, generate practice case studies, and simplify difficult legal concepts. I know this works because I use AI daily for complex professional tasks like sales work, web development, and digital marketing. This guide shows you exactly how to transform AI into a personalized study tool to leave the stress behind and start studying smarter.

How Gemini Helps With B.Com Subjects

| Focus Area | What Gemini Does | Your Benefit |

|---|---|---|

|

|

Transaction Logic Breakdown

|

You will stop feeling scared when your balance sheet doesn't match. By learning the basic logic instead of just memorizing, you can fix mistakes quickly. |

|

|

Variance & Ratio Analyst

|

You won't just be a person who plugs numbers into a calculator. You will understand the real business story the data is telling you, solving problems faster. |

|

|

Provision Clarifier

|

Tax can be scary because rules change often. This tool makes sure you are always learning the most recent rules, helping you score high marks. |

|

|

Case Law Interpreter

|

It bridges the gap between reading a law book and using it. You will learn how to write professional legal answers using the right words. |

|

|

Market Dynamics Tutor

|

By connecting theories to the real world, you’ll find it much easier to remember concepts and draw accurate diagrams for your answers. |

|

|

Algorithm Simplifier

|

You will stop fearing math and start seeing it as a tool. You will know how to use formulas, giving you confidence for honors papers. |

|

|

Standard Practice Guide

|

This tool makes auditing practical, helping you remember the steps easily so you can write high-scoring answers without getting confused. |

|

|

Strategy Architect

|

By using real-world, modern examples in your theory answers, you show the examiner you really understand the subject, ensuring the best marks. |

How AI Boosts Your Efforts : Data From Recent Studies

The shift from traditional study to AI-powered learning is backed by two major realities: how the Finance Industry has evolved in 2025, and how Educational Science proves that students learn faster when they “interact” with data rather than just reading it.

| Research Metric | Evidence & Analysis | Academic Significance |

|---|---|---|

| 20–35% higher academic scores Active Learning Meta-Analysis |

AI-Supported Active Learning Improves Commerce Performance

|

What This Means

AI shifts learning from passive reading to continuous recall and application, raising baseline academic performance.

B.Com Edge: Stronger scores in Accounting, Economics, and Business Studies.

|

| 25–35% weak-subject improvement Microsoft–Cambridge (2025) |

AI-Based Diagnostics Fix Silent Score Losses

|

What This Means

AI identifies the exact chapters pulling your percentage down instead of letting weaknesses hide behind averages.

B.Com Edge: Prevents marks loss in Cost Accounting, Taxation, and Statistics.

|

| 30–40% better long-term retention Spaced Practice Research (Cepeda et al.) |

AI-Optimised Spaced Revision Preserves Theory

|

What This Means

AI keeps theoretical concepts active in memory, not just temporarily memorised for exams.

B.Com Edge: Higher retention in Business Law, Economics, and Management theory.

|

| 60–70% higher study consistency Student Learning Analytics |

AI Improves Consistency Across Academic Years

|

What This Means

Instead of short bursts of cramming, AI promotes steady, sustainable academic progress.

B.Com Edge: Better internals, projects, and final exam performance.

|

Advanced Prompting Techniques by Google for 2026, with Examples Prompts For B.Com

Google Gemini is a Reasoning Engine. To get "A+ Grade" results for B.Com and professional finance students, move beyond basic questions using these six pillars.

- The Technique: Setting the Persona, Task, Context, and Format.

- The Logic: AI is a reasoning engine that adapts to the "identity" and "environment" you provide. Assigning a professional role like "Chartered Accountant" ensures the AI uses proper financial terminology, while the Context "fences" it into specific standards (like IFRS or GST rules) to avoid generic or outdated advice.

Persona: Act as an [Any Expert Role: e.g., Chartered Accountant, Corporate Lawyer, Financial Auditor]. Task: Explain [Your Topic: e.g., Double Entry System, GST Input Tax Credit, Company Liquidations]. Context: Apply this specific background: [Source Context: e.g., Use only the latest Income Tax Act 1961 guidelines] [Difficulty Context: e.g., Explain for a 1st-year B.Com student] [Regional Context: e.g., Assume the business is operating in India] Format: Provide the answer as a [Structure: e.g., Comparison Table, 5-Point High-Yield List].

- The Technique: Breaking a problem into a "Step-by-Step" sequence with logic checks.

- The Logic: Accounting and Finance problems require a strict sequence (like moving from Journal to Ledger). This version forces the AI to "Self-Correct"—cross-checking the totals and rules of the previous step before it attempts the next entry.

Solve this [Subject: e.g., Partnership Accounts, Costing, Statistics] problem using Chain-of-Thought. Step 1: List all given [Variables/Account Balances] and adjustments from the question. Step 2: State the core [Accounting Rule/Formula] and verify its relevance to the problem. Step 3: Show the calculation step-by-step, verifying that debits equal credits at each stage. Question: [Insert your practical problem here]

- The Technique: Limiting the AI to official domains with a focus on recent data.

- The Logic: Tax rates, interest rates, and corporate laws change every year. This "Time-Stamp" filter forces the AI to ignore third-party blogs and prioritize official portals (like the MCA or RBI) from the last 12 months for 100% accuracy.

Research the [Topic: e.g., 2026 Budget Tax Slabs, New SEBI Guidelines]. Constraint: Only use info from official portals: [Domain 1: e.g., incometaxindia.gov.in] and [Domain 2: e.g., mca.gov.in]. Recency Rule: Prioritize data published in the last 12 months. Output: Provide the official summary and the direct link to the source.

- The Technique: Setting strict "Rules of Play" including forbidden keywords.

- The Logic: For theory papers, you need sharp, mark-winning points. By setting hard boundaries and forbidding "AI-voice" fillers (like "In conclusion"), you get sharp, exam-ready definitions and concepts.

Explain [Concept: e.g., Maslow's Hierarchy, Law of Diminishing Marginal Utility]. Constraint 1: Use only [Specific Source: e.g., Standard University Textbook] terminology. Constraint 2: Keep the response under [Limit: e.g., 80 words]. Constraint 3 (Negative): Do not use AI-filler phrases like "Here is the summary" or "It is important to note." Format: Use simple bullet points.

- The Technique: Using a Feedback Loop with an "Active Recall" check.

- The Logic: Treat the AI like a senior professor. This version forces the AI to stop and ask you a question after its explanation, ensuring you actually understood the concept before moving on.

Explain [Topic: e.g., Monetary Policy, Contingent Liabilities]. Instruction: Provide a conceptual business summary first. Feedback Loop: Ask me if I want a real-world business case study or a technical accounting explanation. Active Recall: Once I am satisfied, provide one 'Check-for-Understanding' question based on your explanation.

- The Technique: Providing a structural blueprint before injecting raw data.

- The Logic: This is the most efficient way to build professional documents. You command the AI to build a specific result (like a Ratio Analysis table) using a layout you provide, ensuring it is 100% accurate to your needs.

Make a [Desired Output: e.g., Ratio Analysis Table, Audit Checklist, Comparison Chart]. Layout Blueprint: [Structure: e.g., 3-column table, Markdown grid]. Style: [Vibe: e.g., Professional, Corporate Minimalist]. Strict Rule: Adhere to the structure provided; no conversational filler. Use this information: [PASTE_FINANCIAL_DATA_OR_TEXT_HERE]

Note :

- “The techniques and prompt engineering principles you learn in this guide are universally applicable to any large language model (LLM), including ChatGPT and Perplexity AI. We use Google Gemini for all examples because its latest multimodal features and integration with Google Search provide a best-in-class learning experience.”

- “Remember: The quality of the AI’s answer depends entirely on the clarity of your prompt. Always be specific, detailed, and clear with the AI to avoid irrelevant or incorrect (hallucinated) responses.”

Using Google Gemini App Input Method’s For B.Com

1. Text Prompts

This is your main tool for asking tough, detailed questions about any of your B.Com subjects. Think of it as sitting down to have an in-depth discussion with your tutor.

For example, you can ask Gemini to:

Explain a tricky accounting rule in simple terms.

Give you a step-by-step guide to an economic theory.

Compare two different management styles for you.

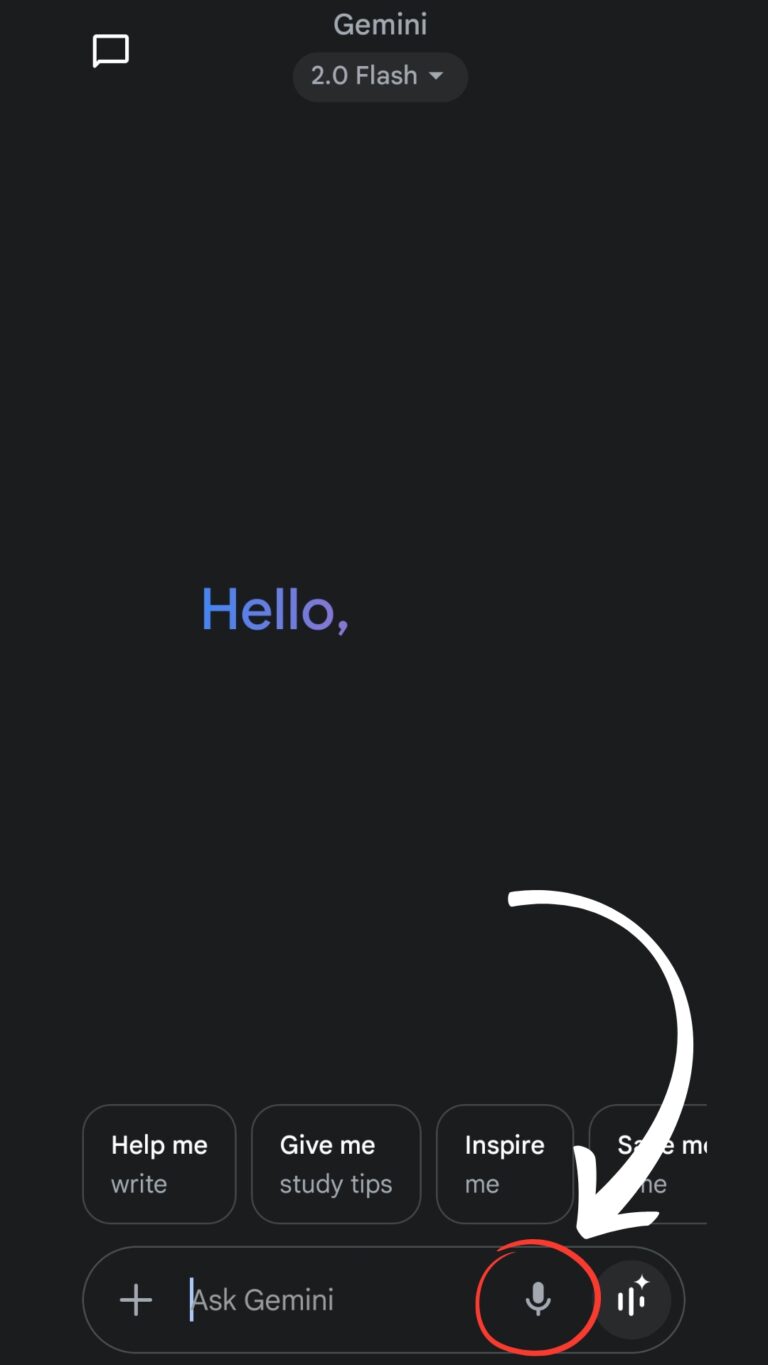

2. Voice Input

Think of this as having a quick chat with your tutor when you don’t have time to type. It’s super convenient for getting fast answers on the go.

This is perfect when you need to:

Quickly review a key term before a test.

Brainstorm a business idea out loud.

Ask a question while you’re commuting.

3. Image Input

Ever get stuck on a confusing chart or table in your textbook? This feature is like pointing at it and asking your tutor, “What does this mean?”

If you see a complex financial statement, a tricky economic graph, or a detailed chart, just snap a clear picture and upload it. You can then ask specific questions about the image, like, “Can you explain this trend to me?” or “What’s the most important takeaway from this report?”

Questions From The B.Com course syllabus solved using Google Gemini :

Example 1: B.COM Accounts

Financial Accounting (Branch Accounts)

Official Path: Accounting for Inland Branches (Synthetic Method)

Synthetic Method and Loading Analysis

Research "Conversion of Rate of Loading" and "Synthetic Method of Branch Accounting." In professional examinations, distinguishing between "Loading on Cost" and "Loading on Invoice Price" is a key area for precision. Grounding the prompt in the "Stock Reserve Calculation" ensures the calculation reflects the unrealized profit in closing stock, providing accuracy for auditing standards.

Study Lab

B.Com Accountancy Prep

"A Head Office in Mumbai supplies goods to its Branch in Delhi at a loading of **25%** on cost. During the year, goods worth **Rs. 1,00,000** (at invoice price) were sent to the branch. The branch returned goods worth **Rs. 5,000** (at invoice price). Calculate the 'Branch Stock Reserve' to be adjusted in the General Profit & Loss Account and explain the treatment of 'Loading' in the Branch Account under the Debtors System."

"Act as a Chartered Accountant and Professor of Accountancy (Persona). Explain the concept of Invoice Price and Loading (Subject) in Branch Accounting (Context). Focus on why the Head Office invoices goods above cost and the necessity of removing the loading for final accounts. Provide a mathematical explanation (Format) for converting loading from 'on cost' to 'on invoice price'."

"Analyze the calculation of Goods Sent to Branch (Net) using Chain-of-Thought. Step 1: Calculate the Net Goods Sent at Invoice Price. Step 2: Apply the loading conversion factor to find the total loading (Profit element). Step 3: Detail the journal entries required to cancel the loading in the Branch Account. Step 4: Verify the 'Cost Price' of net goods sent to ensure accuracy."

"Create a 3-column Accounting Treatment Grid for Branch Loading Adjustments. Column 1: Transaction Item. Column 2: Placement for Removal (Debit/Credit side). Column 3: Purpose of Adjustment. Constraints: Use Markdown table format. No conversational filler. Ensure 100% accuracy for B.Com financial accounting prep."

Accountancy Prep Lab • Optimized for Precision

Gemini can further elaborate by:

- Providing definitions and explanations of various accounting terms and concepts.

- Illustrating the relationships between different financial statements.

- Testing your understanding of accounting principles with practice questions relevant to your B.Com syllabus.

Example 2: B.COM Economics

Business Economics (Consumer Behavior)

Official Path: Microeconomics: Theory of Consumer Behavior (Indifference Curve Analysis)

Ordinal Utility and Equilibrium Analysis

Research "Ordinal Utility Analysis" and the "Consumer Equilibrium Tangency Condition." In Business Economics, understanding how the budget line shifts due to price changes (the Price Effect) is a central topic. Grounding the prompt in the "Law of Diminishing Marginal Rate of Substitution" helps explain why equilibrium happens at a specific point where satisfaction is highest.

Study Lab

B.Com Economics Prep

"A consumer has a fixed income of Rs. 2,000 and consumes two goods, X and Y. The price of Good X is Rs. 50 and the price of Good Y is Rs. 40. Explain the concept of the 'Budget Line' and the 'Marginal Rate of Substitution' (MRS). Determine the consumer's equilibrium condition using Indifference Curve analysis and explain what happens if the price of Good X falls to Rs. 25."

"Act as an Economics Professor (Persona). Explain the concepts of the Budget Line and the Indifference Curve (Subject) in the context of consumer choice (Context). Focus on the 'Budget Constraint' formula and the 'Ordinal Utility' approach. Provide a detailed conceptual explanation (Format) of why an Indifference Curve is convex to the origin."

"Analyze the Consumer Equilibrium and Price Effect using Chain-of-Thought. Step 1: State the mathematical condition for consumer equilibrium (Slope of IC = Slope of Budget Line). Step 2: Calculate the initial slope of the budget line (Price Ratio). Step 3: Explain the shift in the budget line when the price of Good X falls to Rs. 25. Step 4: Verify the new equilibrium position and the 'Substitution Effect' vs. the 'Income Effect'."

"Create a Business Economics Logic Map for analyzing Market Changes. Include scenarios for Increase in Income, Decrease in Price of Good X, and Change in Consumer Tastes. Constraints: Use a bulleted hierarchy. No conversational filler. Ensure 100% accuracy for B.Com Business Economics prep."

Economics Prep Lab • Optimized for Analysis

Gemini can further elaborate by:

- Providing definitions and explanations of various macroeconomic terms and concepts.

- Illustrating the impact of different government policies (fiscal and monetary) on the AD-AS model.

- Testing your understanding of macroeconomic principles with scenario-based questions relevant to your B.Com syllabus.

Example 3: B.COM Business Law

Business Law (Indian Contract Act, 1872)

Official Path: Law of Contract (Offer and Acceptance)

Legal Precedent Analysis and Doctrine of Communication

Research the landmark case "Lalman Shukla v. Gauri Dutt (1913)" and the "Doctrine of Communication of Offer." In Business Law, Legal Precedent Analysis is the backbone of a high-scoring answer. Grounding the prompt in Section 4 of the Indian Contract Act ensures the output explains why an offer is only valid when it is communicated to the offeree.

Study Lab

B.Com Business Law Prep

"A person, Mr. Sharma, advertised in a newspaper that he would pay Rs. 10,000 to anyone who finds his lost dog. Mr. Gupta, a neighbor, found the dog and returned it to Mr. Sharma without being aware of the advertisement. Later, when Mr. Gupta learned about the reward, he claimed it. Mr. Sharma refused to pay. Explain the concept of 'Communication of Offer' and 'General Offer.' Determine whether Mr. Gupta is entitled to the reward under the Indian Contract Act."

"Act as a Legal Consultant and Law Professor (Persona). Explain the concepts of General Offer and Communication of Offer (Subject) under the Indian Contract Act, 1872 (Context). Focus on Section 4 of the Act. Provide a legal definition breakdown (Format) of why an offer must be known to the offeree to result in a contract."

"Analyze the case study of Mr. Sharma and Mr. Gupta using Chain-of-Thought. Step 1: Identify the nature of the advertisement. Step 2: Assess whether there was a valid communication of the offer to Mr. Gupta at the time of performance. Step 3: Apply the precedent of Lalman Shukla v. Gauri Dutt. Step 4: Verify if a legal contract was formed and state the final verdict on the reward claim."

"Create a Legal Case Briefing Structure for analyzing Contractual Validity. Include sections for Legal Provision, Essential Requirement, 'Fatal Flaw', and Practical Defense. Constraints: Use a structured list format. No conversational filler. Ensure 100% accuracy for B.Com Business Law prep."

Business Law Prep Lab • Optimized for Precedents

Gemini can further elaborate by:

- Providing definitions and explanations of various legal terms and principles related to contract law.

- Illustrating different legal precedents and case laws relevant to the Doctrine of Frustration.

- Testing your understanding of business law concepts with hypothetical scenarios relevant to your B.Com syllabus.

Using Google Gemini for B.Com Course and Exam Research

What is Deep Research?

Deep research for B.Com involves using Google Gemini to connect textbook theories in accounting, law, and economics with real-world financial data and corporate updates. It turns the AI into a research partner that helps you understand the "Why" behind financial standards and business regulations, moving beyond rote learning to the analytical mindset required for a career in commerce.

How It Helps You

- Practical Application of Standards: Commerce exams often ask for applications of Accounting Standards (AS/Ind AS) or Audit procedures. Gemini helps you find the practical context and recent changes in these standards.

- Case Study Analysis: Deep research allows you to break down Business Law or Management case studies, helping you master the logic behind legal precedents and corporate governance issues.

- Economic & Market Integration: Stay updated on the latest Repo rates, GST amendments, and Union Budget impacts—topics that are critical for your Economics and Taxation papers.

- Financial Statement Breakdown: Instead of just learning theory, Gemini can research the annual reports of real companies to help you understand how to read and analyze real-world balance sheets.

Grounding and Context

What it is: "Grounding" means tethering Gemini to official regulatory sources so it doesn't give you unverified or outdated financial info that could lead to incorrect exam answers.

Why it matters: Tax laws and accounting rules change every year. Grounding ensures you are studying from the Ministry of Corporate Affairs (MCA), ICAI, and RBI guidelines.

How you do it:

1. Download the latest official University syllabus or Professional body handbook (like ICAI/ICS) PDF.

2. Upload the PDF to Gemini.

3. Use the command: "Filter all your future research through the specific sections and legal amendments found in this official B.Com syllabus."

Google Suggested Prompt Method

The "System, Task, Range" MethodUse this structured method to ensure Gemini acts like a senior auditor or commerce professor rather than a general information chatbot.

“Act as a B.Com academic expert. Your task is to research the latest amendments in the Companies Act 2013 or Income Tax Act applicable for the 2024-25 assessment year. Write a 200-word summary of the top 3 changes and create three practice MCQs based on this research. Use only official government and ICAI sources.”

The India Should Know Technique

The "Reverse Engineering" MethodReverse-engineer your study notes by describing the exact professional depth and tabular format you need before the AI processes the raw commerce data.

“I want to create a high-density comparison table for [Accounting Concepts, e.g., Cash Flow vs Fund Flow]. Format: A 4-column table (Basis of Difference, Cash Flow, Fund Flow, Why This Matters for Audit). Tone: Professional, analytical, and precise. Intent: To master conceptual differences for a 15-mark theory question. Constraints: No fluff. Every point must be under 15 words. Use the official textbook context I provided. Once generated, I will ask you to create a logic-based journal entry question for this table.”

Tips for Better Deep Research

- The "Logic Loop": After an answer, ask: "What is the most common reason a student fails to tally the balance sheet in this specific scenario?" to identify common calculation traps.

- Verify Regulatory Stats: Always use the "Google" search button to verify the latest SLR, CRR, or GST slab percentages mentioned in your economics and tax research.

- Visual to Text: If you are studying complex organizational structures or cost-sheets, describe the workflow to Gemini and ask it to explain the "unseen" financial impact of each step.

- Chain of Reasoning: For accounting journal entries, tell Gemini: "Explain the Debit/Credit logic for this transaction step-by-step so I can apply the 'Golden Rules of Accounting' under pressure."

AI Guided Learning For B.Com, Turn Google Gemini into Your Personal Coach

What is Guided Learning with AI?

For B.Com students, guided learning with AI is like having a personal Chartered Accountant or Finance Professor available 24/7 to help you understand the logic behind ledger entries, economic theories, and legal frameworks. Instead of just copying solutions for Accountancy or Law, you use Gemini to simulate a teaching environment. It identifies gaps in your conceptual understanding and explains complex commerce principles in ways that match your learning style.

How it helps you for this course/exam

- Master Accounting Logic: Struggling with 'Double Entry' or 'Consolidation of Accounts'? Gemini can explain the logic behind specific adjustments, ensuring you understand why a transaction is debited or credited rather than just memorizing the format.

- Simplify Legal Frameworks: Business and Corporate Law sections can be dry. Gemini can turn complex legal clauses into relatable business scenarios, making it easier to answer case-study-based questions in the exam.

- Economic Analysis: It can act as an economist, helping you visualize the relationship between variables in Macro and Microeconomics through real-world market examples.

How to do it in short

1. Define the Role: Tell Gemini it is an expert Professor specializing in B.Com subjects like Accountancy and Audit.

2. Set the Boundary: Tell it NOT to solve the problem for you—insist on guiding you through the steps first.

3. Interactive Dialogue: Ask it to quiz you on a specific accounting standard or a legal provision one question at a time.

4. Feedback Loop: Provide your reasoning for a solution, and let the AI correct your professional logic.

Google Suggested Method: Conversational Scaffolding

Google’s recommended approach focuses on "conversational scaffolding." For B.Com, this means starting with basic principles (like the matching principle) and letting the AI guide you toward complex applications (like deferred tax calculations) through a back-and-forth chat.

“I am studying for my B.Com exams, specifically focusing on [Subject/Chapter]. I want you to act as a supportive professor. Start by asking me what I already know about [Specific Topic], and then help me build my understanding by asking follow-up questions that connect basic concepts to professional exam-level problems. Don't give me all the information at once; let's take it step-by-step.”

Google Suggested Method: The Socratic Method

The Socratic method is the gold standard for mastering business logic. Instead of the AI explaining an accounting entry or a law case to you, it asks you a series of disciplined questions. This forces you to think through the professional logic yourself, which is critical for long-term retention.

“I want to learn the core logic behind [Topic]. Act as a Socratic tutor for B.Com prep. Do not give me the explanation. Instead, ask me a leading question that helps me realize the core principle or professional logic behind this. Once I answer, ask another question to push my thinking into practical application until I have fully grasped the concept.”

The India Should Know Method

The "Reverse Engineering" MethodThe India Should Know method is about Reverse Engineering. Instead of letting the AI wander, you put heavy constraints on the output. You define the exact "shape" of the session—specifying the need for high-density exam formats—before you ever give it the raw textbook data or university syllabus.

“Intent: Act as an expert B.Com Professor specializing in [Subject]. Context: I am preparing for my final university exams and need to master [Chapter/Topic]. Format Constraints: * Conduct a 'Step-by-Step Problem Solving' or 'Legal Case Study' session. * Ask exactly one question or sub-part at a time. * Wait for my response before moving to the next adjustment. * If I am wrong, provide a conceptual hint rather than the final figure. * Use a professional and encouraging tone. * After 5 questions, provide a 'Conceptual Gap Report' in a table format (Column 1: Commerce Concept, Column 2: Mastery Level 1-10, Column 3: Professional Improvement Area). Raw Data: [Paste your notes, textbook questions, or syllabus here] Instruction: Once you understand these constraints and the data provided, acknowledge this by asking the first question.”

Tips for Guided Learning

- Be Honest with the AI: If you don't understand an audit hint, say "I don't understand the legal context of this, explain it like a business scenario." The AI can pivot its teaching style instantly.

- Use Voice Mode for Theory: If you are on the Gemini app, use Gemini Live. Talking through Management or Business Law theory out loud helps build the clarity needed for writing long-form exam answers.

- Feed it Past Year Papers: Paste specific tricky questions from previous university exams into the "Raw Data" section. This ensures the AI quizzes you on the exact difficulty level expected in your B.Com degree.

- Review the Gap Report: Don't just finish the session. Look at the "Conceptual Gap Report" and ask Gemini to create a 15-minute summary notes sheet just for the areas where you need more clarity.

Note: Once Gemini produces the outcome based on these prompts, you can further improve it by saying: "That was great, but make the questions more focused on [Specific Sub-topic] and use more practical business-style examples."

Important Links For B.com, Resource Command Center

Using Gemini is powerful, but AI works best when you feed it primary data. These links provide the official documents, tax slabs, and legal acts you need to stay ahead of your syllabus and your peers.

1. The "Big Three" Statutory Portals

These are essential for every B.Com student, especially those aiming for CA, CS, or CMA.

ICAI Knowledge Portal: Even if you aren’t a CA student, this is the best source for high-quality study material on Accounting Standards (AS) and Ind-AS.

MCA (Ministry of Corporate Affairs): The official home of the Companies Act 2013. Use this to download real company Balance Sheets for your projects.

Income Tax Department (India): Access the 2025-26 Tax Charts. Use this to verify that the tax sums you are solving match the latest government laws.

2. Market & Project Data (For Finance & Stats)

Stop using Wikipedia for your B.Com projects. Use the same data sources professional analysts use.

NSE (National Stock Exchange): The gold standard for Live Market Data. Perfect for projects on Ratio Analysis or Stock Market trends.

RBI (Reserve Bank of India): The source for Monetary Policy updates. Essential for Economics students to understand current Repo Rates and Inflation data.

SEBI Reports & Statistics: Deep research reports on investor protection and corporate governance—excellent for high-scoring final year dissertations.

3. Regulatory & Legal Updates

GST Council (Official): For the latest notifications on GST rate changes (crucial for Indirect Tax papers).

India Code (Digital Law Library): A searchable database for the Contract Act, Sale of Goods Act, and Partnership Act in their most updated form.

How to use these with Gemini:

Copy-Paste Pro-Tip: Find a complex section in a PDF from these links (like a new GST notification). Paste it into Gemini and say: “Explain this 2025 amendment to me like I am a B.Com student. Give me 2 numerical examples of how this changes a company’s tax liability.”

Tackle B.COM with AI Guidance

A B.Com degree is more than just a certificate; it is the foundation of your professional identity in the global market. However, in 2025, being “good with numbers” is no longer enough. To stand out to top firms like the Big 4 (Deloitte, EY, PwC, KPMG) or thriving Fintech startups, you must evolve into a Tech-Forward Finance Professional.

By integrating Google Gemini into your studies, you aren’t just preparing for a semester exam—you are mastering the digital tools that define modern commerce. You have learned how to automate financial audits, decode complex legal acts, and conduct deep research that goes beyond the classroom. You are no longer just a student; you are a practitioner of AI-driven business intelligence.

The corporate world moves fast, and the tools you use today will determine where you sit in the boardroom tomorrow. The roadmap is in your hands. Now, take the first step. Start by using the “Interleaved” schedule we built, try the Socratic guided prompts for your toughest subject, and turn your B.Com journey from a standard degree into a competitive advantage.

Your career in the new economy starts now. Lead with intelligence.

Written By

Prateek Singh.

Last Updated – December, 2025

About The Author

Prateek Singh believes the best way to learn is to apply knowledge directly. He leverages AI tools every day for his professional work, using them to create sales presentations, perform lead generation, execute data visualization, and manage all digital marketing and SEO efforts. He also used AI to learn the diverse skill set required to build IndiaShouldKnow.com from the ground up, including web development, UI/UX design, color theory, and graphic design. Having researched and utilized dozens of AI tools, Prateek has written over a hundred articles detailing how others can use them to enhance their own learning and productivity. He shares this practical, self-taught knowledge to empower others on their own journey of continuous learning.

FAQs About AI Use.

Can I trust every answer an AI tool gives me for my studies?

A: No, you should not trust every answer completely. Think of an AI as a super-smart assistant that has read most of the internet—but not every book in the library is accurate.

AI can sometimes make mistakes, misunderstand your question, or use outdated information.

It can even “hallucinate,” which means it confidently makes up an answer that sounds real but is completely false.

Rule of Thumb: Use AI answers as a great starting point, but never as the final, absolute truth. Always double-check important facts.

How can I verify the information I get from an AI for my academic work?

A: Verifying information is a crucial skill. It’s like being a detective for facts. Here are four simple steps:

Check Your Course Material: Is the AI’s answer consistent with what your textbook, lecture notes, or professor says? This is your most reliable source.

Look for Reputable Sources: Ask the AI for its sources or search for the information online. Look for links from universities (.edu), government sites (.gov), respected news organizations, or published academic journals.

Cross-Reference: Ask a different AI the same question, or type your question into a standard search engine like Google. If multiple reliable sources give the same answer, it’s more likely to be correct.

Use Common Sense: If an answer seems too perfect, too strange, or too good to be true, be extra skeptical and investigate it further.

What is the difference between using AI for research and using it to plagiarize?

A: This is a very important difference. It’s all about who is doing the thinking.

Using AI for Research (Good ✅):

Brainstorming topics for a paper.

Asking for a simple explanation of a complex theory.

Finding keywords to use in your library search.

Getting feedback on your grammar and sentence structure.

You are using AI as a tool to help you think and write better.

Using AI to Plagiarize (Bad ❌):

Copying and pasting an AI-generated answer directly into your assignment.

Asking the AI to write an entire essay or paragraph for you.

Slightly rephrasing an AI’s answer and submitting it as your own original thought.

You are letting the AI do the thinking and work for you.

How can I use AI ethically to support my learning without violating my school's academic honesty policy?

A: Using AI ethically means using it to learn, not to cheat. Here’s how:

Know the Rules: First and foremost, read your school’s or professor’s policy on using AI tools. This is the most important step.

Be the Author: The final work you submit must be yours. Your ideas, your structure, and your arguments. Use AI as a guide, not the writer.

Do the Heavy Lifting: Use AI to understand a topic, but then close the chat and write your summary or solve the problem yourself to make sure you have actually learned it.

Be Transparent: If you used an AI in a significant way (like for brainstorming), ask your professor if you should mention it. Honesty is always the best policy.

Can an AI's answer be biased? How can I detect this in its responses?

A: Yes, an AI’s answer can definitely be biased. Since AI learns from the vast amount of text on the internet written by humans, it can pick up and repeat human biases.

Here’s how to spot potential bias:

Look for Opinions: Does the answer present a strong opinion as a fact?

Check for One-Sidedness: On a topic with multiple viewpoints (like politics or economics), does the AI only show one side of the argument?

Watch for Stereotypes: Does the answer use generalizations about groups of people based on their race, gender, nationality, or other characteristics?

To avoid being misled by bias, always try to get information from multiple, varied sources.

Is it safe to upload my personal notes, research papers, or assignments to an AI tool?

A: It is best to be very careful. You should not consider your conversations with most public AI tools to be private.

Many AI companies use your conversations to train their systems, which means employees or contractors might read them.

There is always a risk of data breaches or leaks.

A Simple Safety Rule: Do not upload or paste any sensitive information that you would not want a stranger to see. This includes:

Personal identification details.

Confidential research or unpublished papers.

Your school assignments before you submit them.

Any financial or private data.

Sign Up for Our Newsletter To Learn More About the Latest In AI And Learn How To Use It.

Unlock your learning potential and stay ahead in the age of AI! Join the IndiaShouldKnow.com newsletter to discover how to seamlessly integrate Google AI into your studies for school, entrance exams, and college. Plus, get the latest insights on cutting-edge AI tools that can empower your career and enrich your life. Subscribe now for monthly updates.